Balbix for the Finance and Banking Industry

Assess and reduce cyber risk associated with your critical assets and comply with NYDFS, FFIEC, DORA, and others

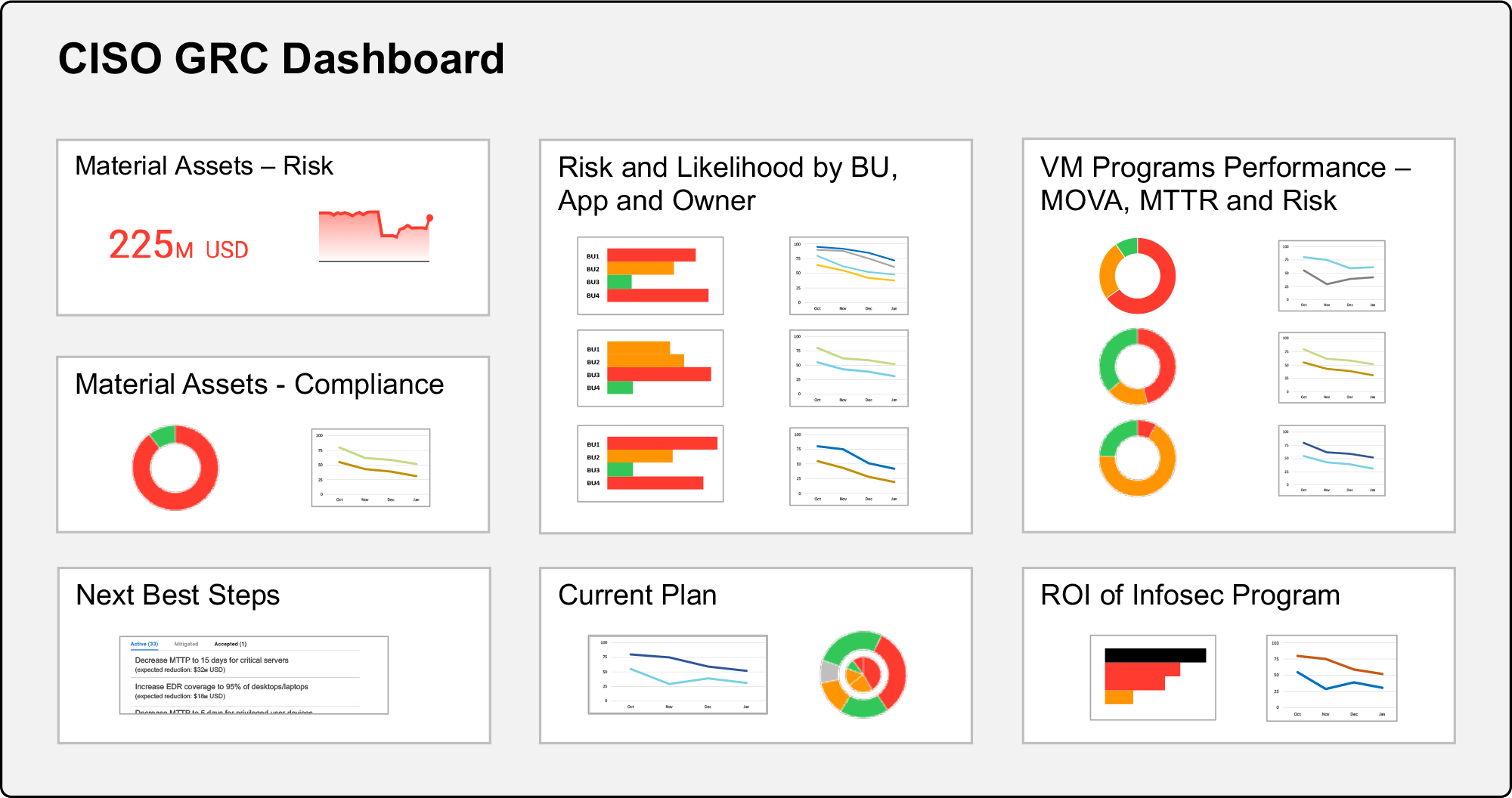

Consolidate legacy and modern infrastructure assets and applications on a single dashboard, along with their vulnerabilities, misconfigurations, threats, and controls.

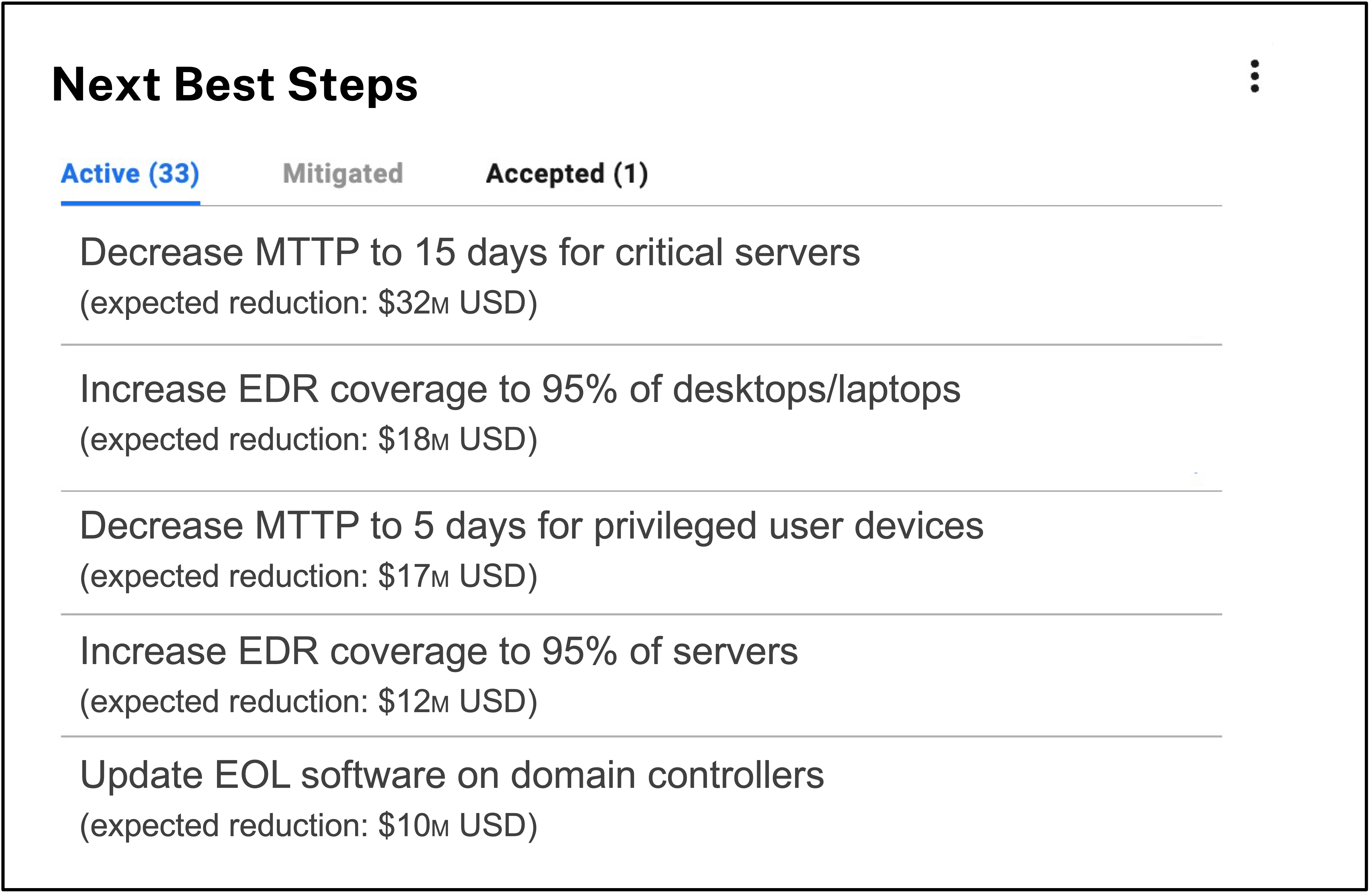

Provide actionable recommendations to reduce cyber risk, along with its estimated monetary impact, to facilitate business decisions.

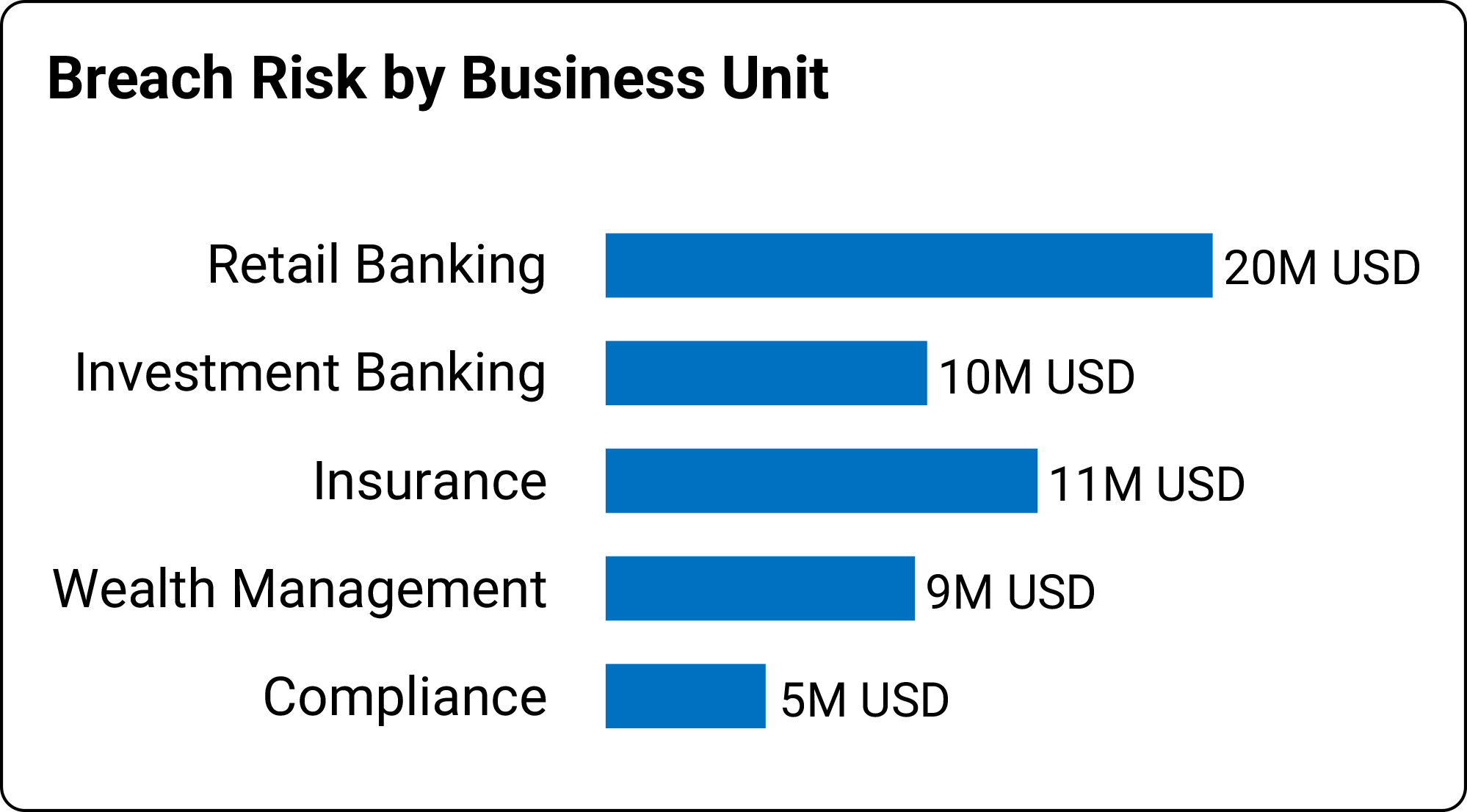

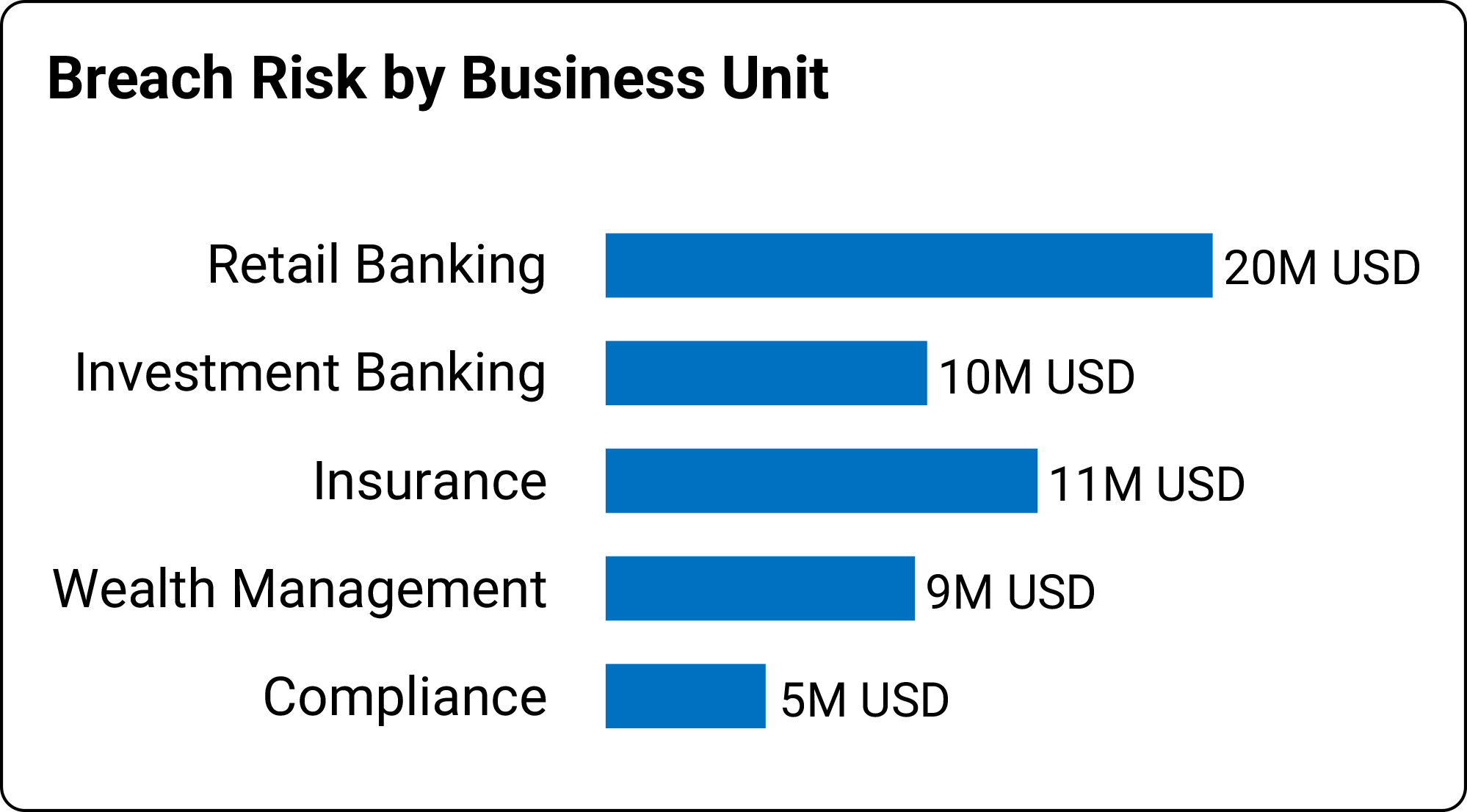

Quantify cyber risk associated with owners and business units in monetary terms to understand the potential impact in a breach scenario.

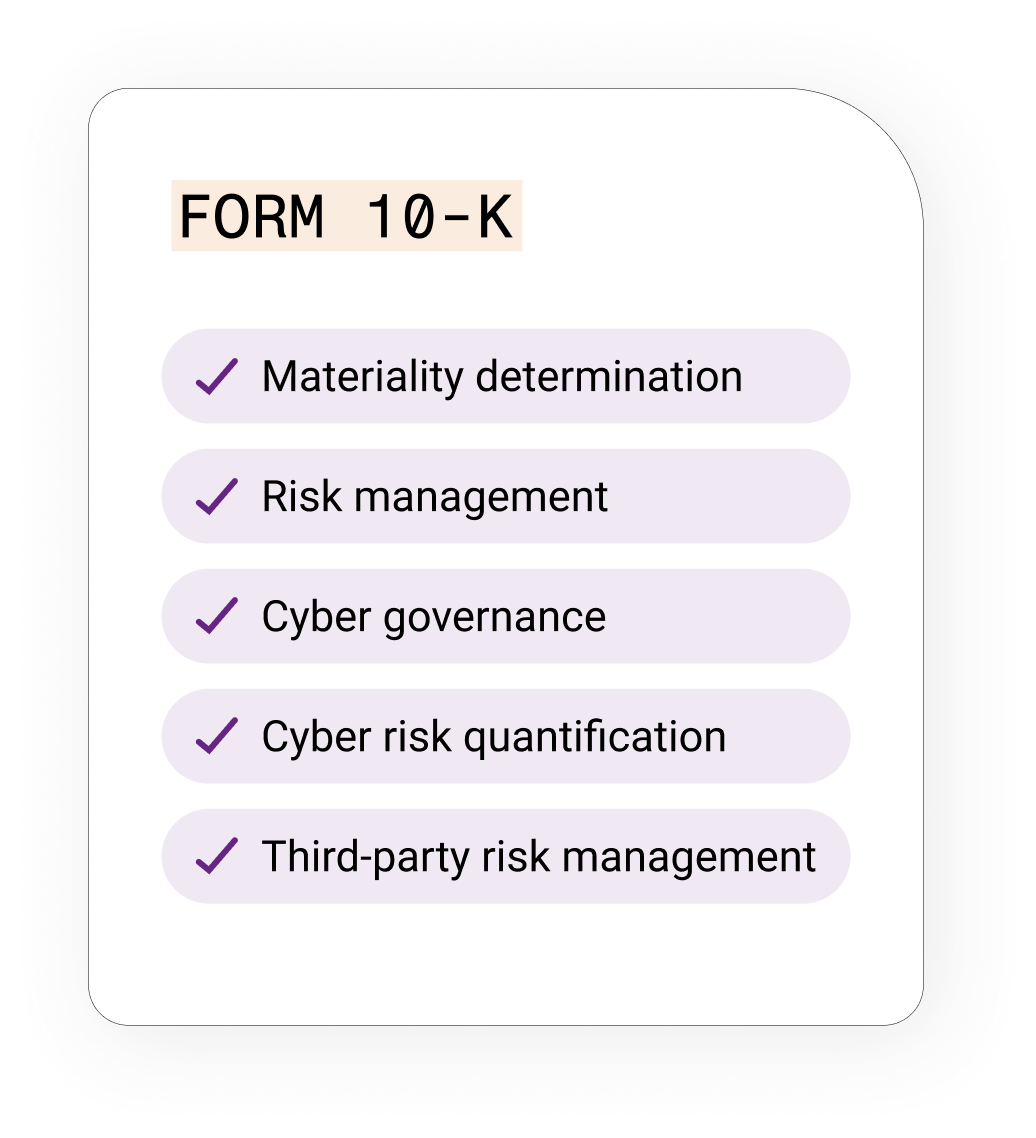

Comply with NYDFS, FFEIC, and other regulatory requirements by providing visibility into the attack surface, vulnerability assessment and prioritization, and materiality determination.

With a data-driven materiality determination framework, security leaders can disclose cyber risk management in 10-K filings, inspiring investor confidence.

Track progress against a framework such as NIST by providing visibility into assets, vulnerabilities, controls, threats, and others that comprise the ‘identify’ function.

Deliver role-specific cyber risk governance dashboards for CISOs, CFOs, and governance officers. Gain real-time visibility into high-risk areas, enabling proactive mitigation.

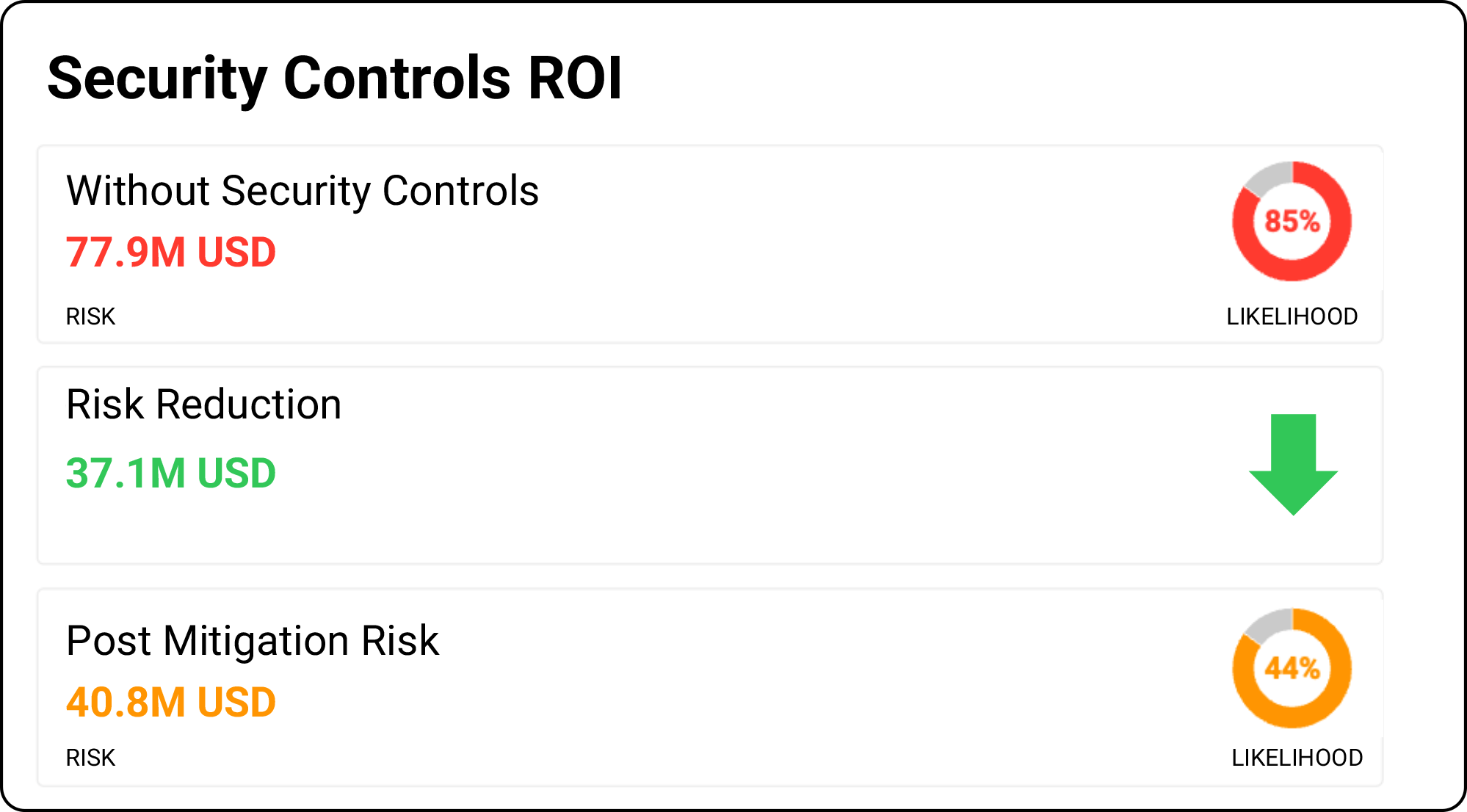

Measure the effectiveness and ROI of your cybersecurity tools and program by computing risk reduction in monetary terms earning the board’s trust and confidence.

“We have invested a lot of money and effort in our security initiatives. With Balbix, for the first time, I could see the overall effect of the cybersecurity program and understand the overlapping functionality of various controls, which helped us streamline and optimize cybersecurity spending.”

John Shaffer, CIO, Greenhill & Co

Get a demo and discover how the world’s leading CISOs use Balbix as the brain of their cybersecurity programs.