April 4, 2024

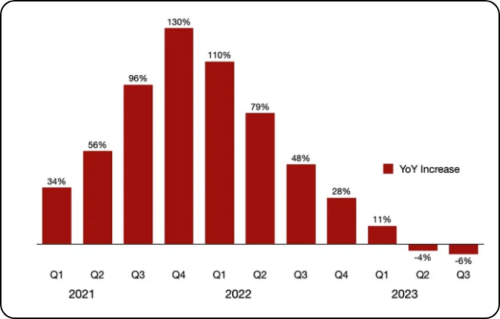

The astronomical cost of cyber insurance has surged in recent years, reflecting the escalating frequency and severity of cyberattacks. As companies rely more on diverse digital platforms and cloud services to do business, often with scattered security oversight, the financial implications of data breaches, ransomware attacks, and other cyber incidents have grown. Dark Reading, in its January 2024 report “With Attacks on the Upswing, Cyber-Insurance Premiums Poised to Rise Too,” stated that despite a lull in premium increases in 2023, they are poised to continue their dramatic rise that started in 2022.

Cyber insurance emerges as a crucial buffer for organizations against the financial fallout from cyberattacks and data breaches. Let’s dive into cyber insurance, who needs it, and how it can be critical to your organization’s risk management strategy.

Below, we’re including a short list of recommendations for reducing cyber insurance premiums. If you want a more comprehensive list, including detailed checklists to help you, take advantage of our eBook, 3 Actionable Steps to Reduce Your Cyber Insurance Premiums.

It all boils down to speaking the language of insurance underwriters: Money. More specifically, money that you save your company and the insurance company will not need to pay out in case of a breach.

Many CISOs mistakenly believe that presenting risks and remediation strategies in technical terms to insurers demonstrates a strong cyber posture and justifies more affordable insurance rates. Insurers, like boards, are not technical experts, and long documents about stopping breaches and mitigating vulnerabilities often cause eyes to glaze over.

The good news is that premiums can be substantially reduced even in this increasingly risky environment by just a few steps to build confidence with your insurer that you are doing everything in your power to reduce your financial exposure and, therefore, theirs.

Even with all of these in place and updates made, organizations need to communicate them to show how they will mitigate potential financial losses in a way that underwriters understand. Having a process for determining materiality in the case of a breach and articulating risk management program success in monetary terms help shift the insurance narrative in your favor.

Balbix simplifies cyber risk assessment for insurance underwriters by providing a comprehensive and measurable understanding of an organization’s risk landscape. It includes the successful implementation of five critical security improvements sought by underwriters, all explained in financial terms. Balbix enables organizations to present essential metrics and evaluate risks in clear terms, such as dollars, through customizable dashboards.

With Balbix’s Cyber Risk Quantification (CRQ), insurance underwriters can access cyber risks quantified in monetary terms and tangible evidence of the effectiveness of cybersecurity investments. Instead of abstract technical metrics, precise, quantifiable data demonstrating how risk mitigation efforts translate into dollars saved is presented.

This shift from technical jargon to monetary values provides insurers with a clear understanding of the potential financial impact of cyber incidents, facilitating more informed risk assessment and pricing decisions.

Balbix offers in-depth insights by linking dollars of risk to specific assets and applications driving the risk. This detailed visibility allows insurance underwriters to identify the most critical areas of vulnerability within an organization’s infrastructure and customize insurance coverage and premiums accordingly.

By speaking the language of insurers—money—and leveraging tools like Balbix’s CRQ to quantify risks and demonstrate financial success, you can unlock significant savings on your cyber insurance premiums. So don’t be fooled into thinking that cost-effective cyber insurance is beyond reach. With the right strategies and evidence-based approach, you can protect your organization’s bottom line while safeguarding against digital threats.

Download our eBook on this topic now and see how Balbix can help you justify lower insurance premiums with Cyber Risk Quantification.